Limited Liability Partnership In Malaysia

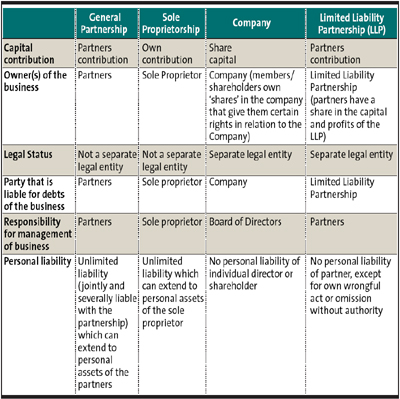

Limited liability partnership llp is a business structure which is governed under the limited liability partnerships or llp act 2012 in malaysia.

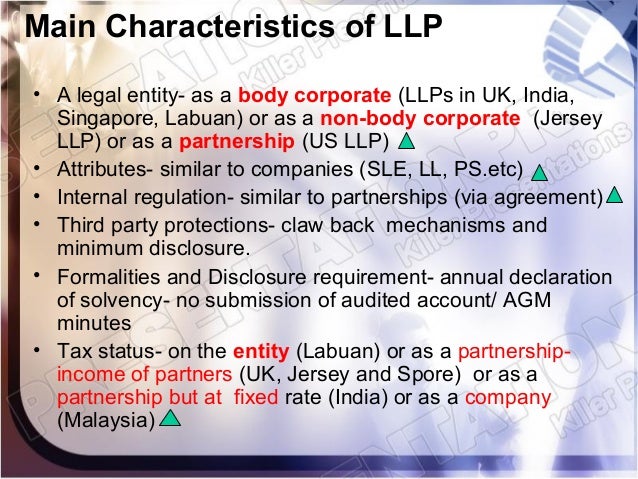

Limited liability partnership in malaysia. There is no withholding tax on. Ssm s practice note no. Introduction to limited liability partnership llp 1 1 about llp llp is an alternative business vehicle to carry out business which combines the characteristics of a private company and a conventional partnership.

The llp business structure is designed for all lawful business purposes with a view to make profit. Vehicles in malaysia 4 1 introduction to llp. Profits paid credited or distributed to partners in the llp are exempt from tax.

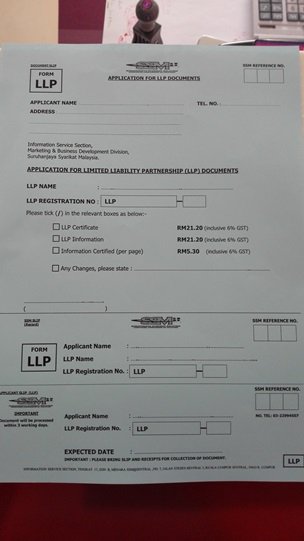

One of the business entities which may be set up in malaysia is the limited liability partnership. Who is it for. So here s how you start a limited liability partnership in malaysia.

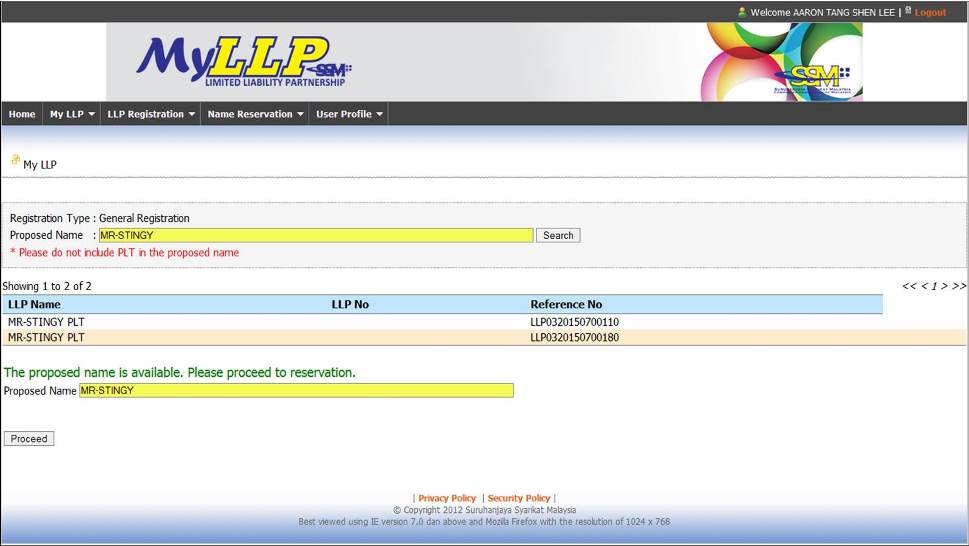

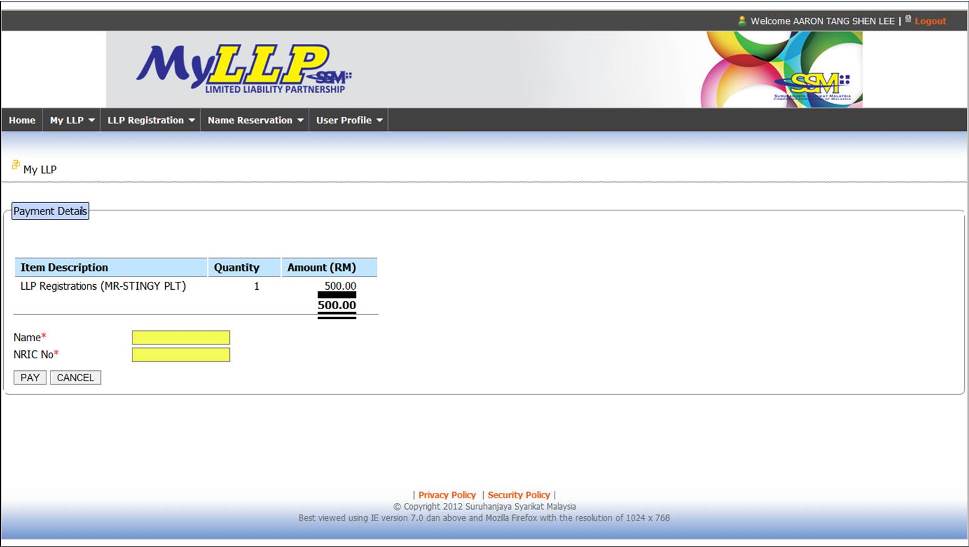

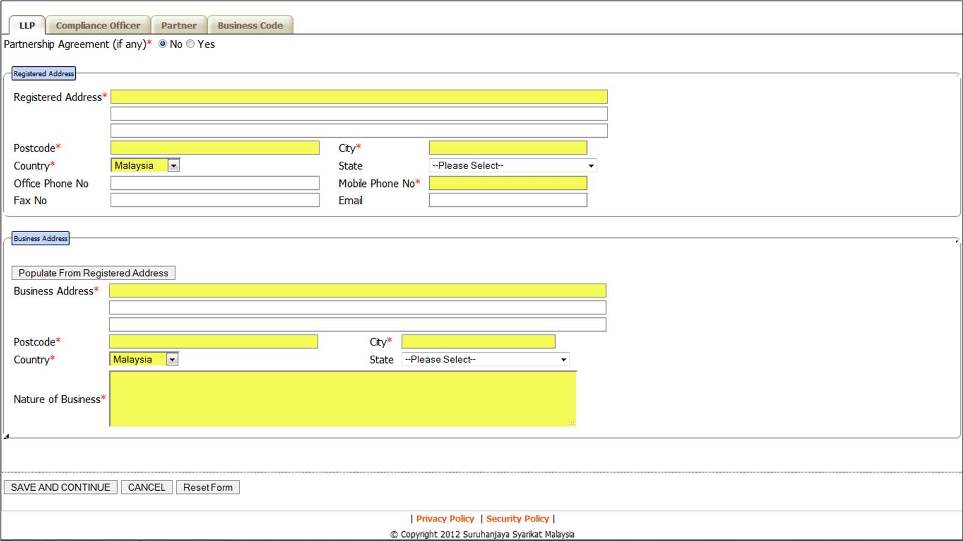

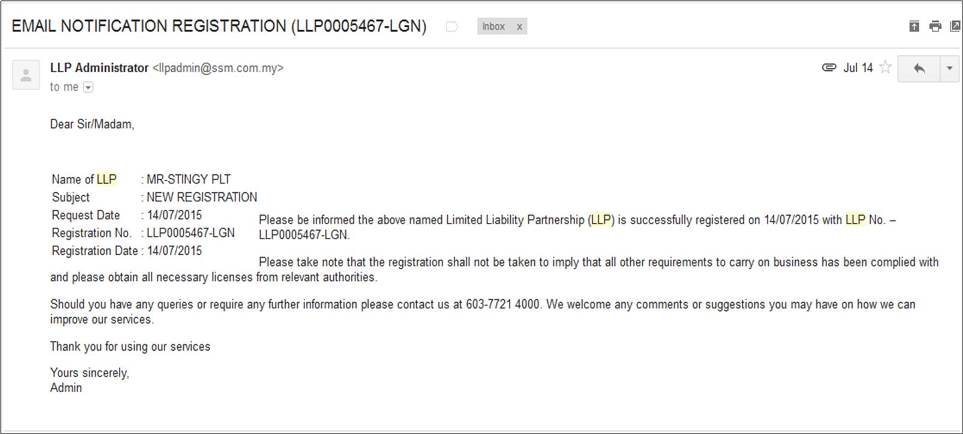

To put it simply an llp provides all the merits of the private limited companies minus their cumbersome reporting requirement. Update 14th dec 2015 ssm has upgraded to myllp 2 0 so a lot of the screens you ll see will be different from my screenshots below. Ssm s practice note no.

Who should go for llp in malaysia. Limited liability partnerships act 2012 acquiring of land by a limited liability partnership and related matters. Taxation for limited liability partnership llp in malaysia.

This page provides a list of the questions most frequently asked by our customers in relation to the set up of limited liability partnership llp in malaysia. However llp with capital contribution of rm2 5 million or less will enjoy a preferential tax rate of 19 on the first rm 500 000 of its chargeable income. Limited liability partnerships act 2012 requirements relating to the lodgement of annual declaration by a limited liability partnership.

It is certainly a viable option for those planning to start a business in malaysia. Llp have a similar tax treatment like company where chargeable income from llp will be taxed at the llp level at tax rate of 24 generally. Register on the myllp system.

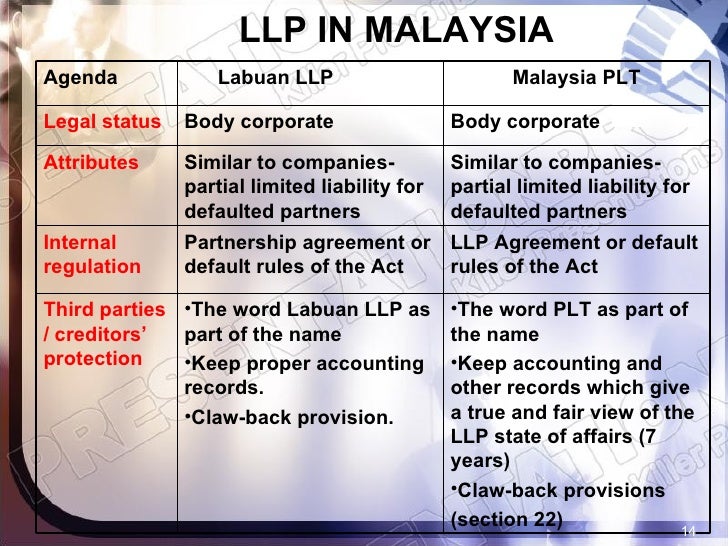

Limited liability partnership llp is an alternative business vehicle regulated under the limited liability partnerships act 2012 which combines the characteristics of a company and a conventional partnership. Tax treatment of llp. A limited liability partnership contains features of both a limited liability company and a partnership.

Start by creating an account on the myllp system by going to their website here. Llp provides limited liability status to its partners and offers the flexibility of internal arrangement through an agreement.