List Of Double Deduction Malaysia

Double deduction incentive on research expenditure addendum to public ruling no.

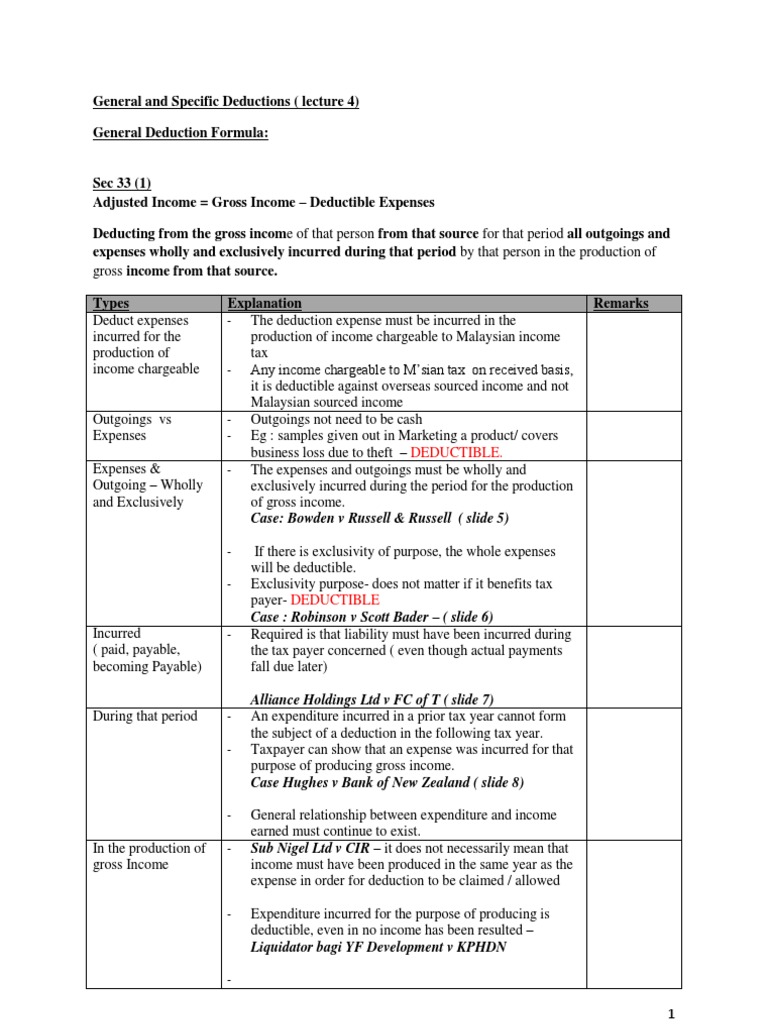

List of double deduction malaysia. 33 of the income tax act 1967 ita 1967 pu a 90 1981 y a 1982 2. Inland revenue board malaysia double deduction incentive on research expenditure addendum to public ruling no. For further information please contact us at.

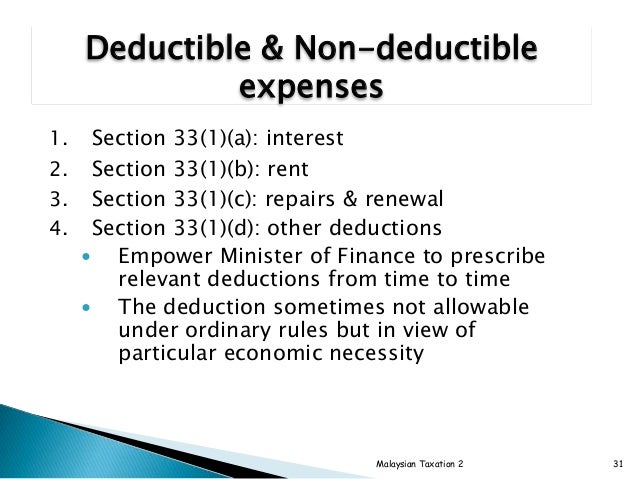

Deductions filing obligations and tax collection chapter 7 other taxes sales tax service tax import duties export duties excise duties stamp duty real property gains tax other levies and taxes chapter 1 investment environment chapter 2 business formation and the regulatory environment chapter 3 labour relations and social security chapter 4 audit requirements and accounting practices contents. Double taxation agreement rates. B5 double deductions type conditions reference and effective date 1.

2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on. 30 december 2004 ii contents page 1. Inland revenue board of malaysia date of issue deductions for promotion of exports public ruling no.

Expenses directly attributable to the provision of samples without charge to prospective customers outside malaysia including. Expenses that qualify for double deductions expenses incurred in respect of publicity and advertisements in any media outside malaysia. Understand the income tax rate and type in malaysia will help your business stay in good compliment.

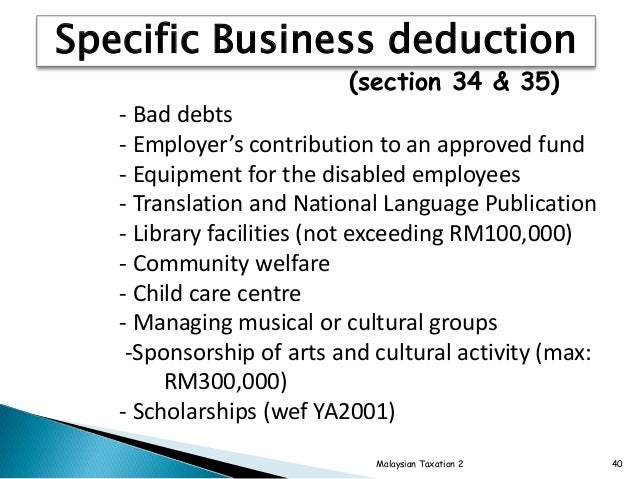

21 21 malaysian tax booklet income tax. Remuneration of disabled employees a employer has to prove to the director general that the employee. Brand promotion advertising expenditure incurred promoting an export quality standard malaysian owned product is subject to double tax deduction.

Types of qualifying expenditure for promotion of export 6 1. Promotion of a brand name means making a name internationally known and therefore would include such expenditure as bill boards in international airports or. Department of international taxation headquarters of inland revenue board of malaysia level 12 hasil tower persiaran rimba permai cyber 8 63000 cyberjaya selangor malaysia.

Timber companies in sabah can deduct double the amount of freight charges incurred. Double deduction incentive on research expenditure inland revenue board public ruling no. 5 2004 date of issue.

Research activities in sectors other than information technology it. Interest payable on loans to small businesses a employer to produce certificate of approval of loan from authority b interest must be allowable under s. Freight charges certain manufacturing industries located in certain regions of the country e g.

One thing worth mentioning is malaysia has an extensive number of double tax treaties available for the avoidance of double taxation. 5 2004 malaysia date of issue. Double deduction with effect from year of assessment 2006 p u a 14 2007 allows for twice the amount of expenses on registration of patents trademarks or product licensing overseas.

Definition of research 1 4. 603 8313 7848 603 8313 7849 e mail. Income tax in malaysia is imposed on income accruing in or derived from malaysia resident and business.

Akta penggalakan pelaburan 1986 double deduction for promotion of exports. 4 february 2013 page 5 of 23 6. Double tax treaties and withholding tax rates real property gains tax stamp duty sales tax service tax other duties important filing furnishing date contact us disclaimer 2018 2019 malaysian tax booklet table of contents 2018 2019 malaysian tax booklet 5.

3 april 2008 director general s public ruling a public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance.