Malaysia Custom Clearance Fee

What are the necessary documents needed for a normal import shipment into malaysia.

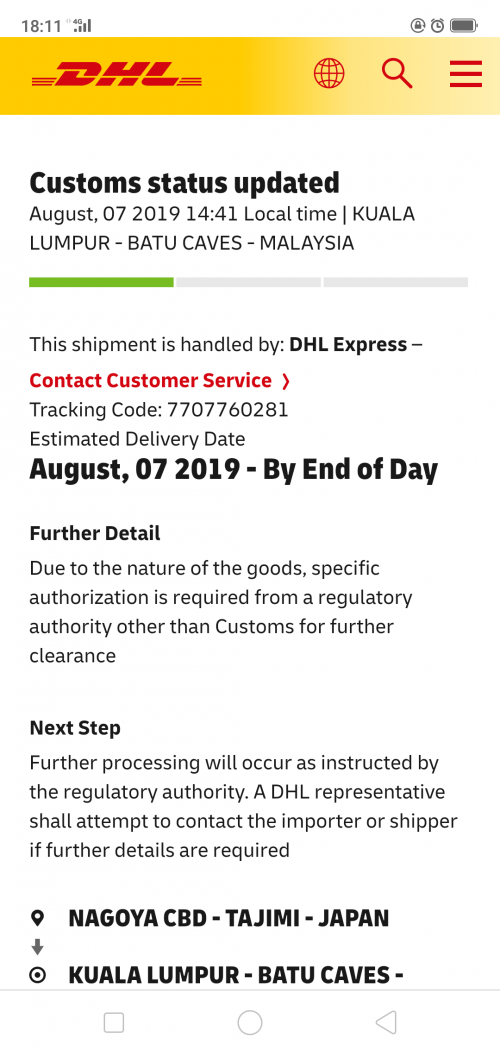

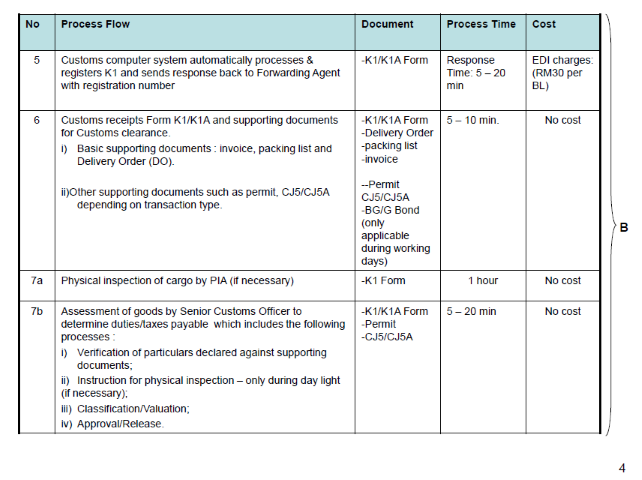

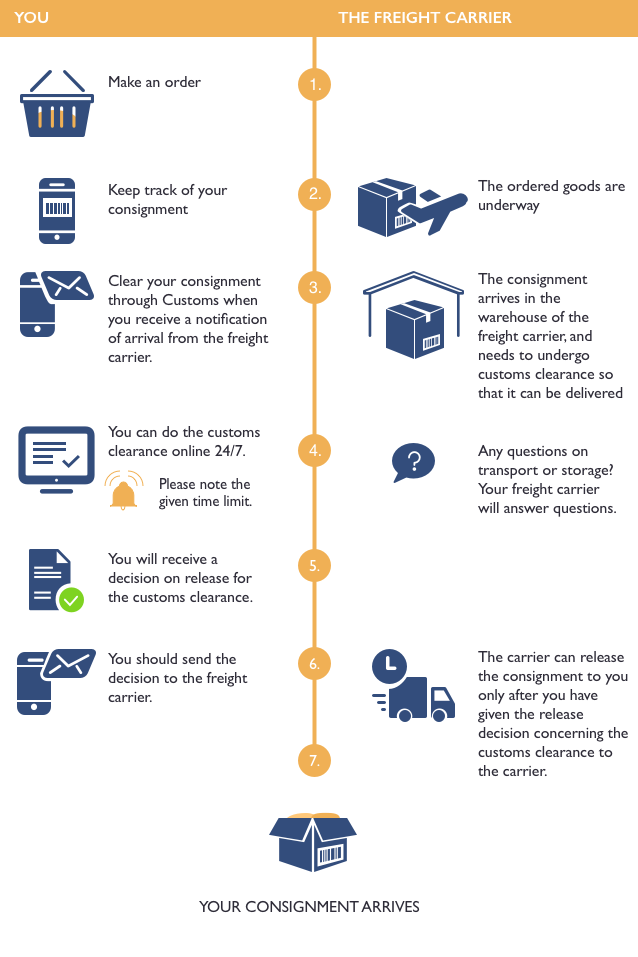

Malaysia custom clearance fee. Customs clearance process will start when we dhl express at destination country receive the invoice and other relevant document image from dhl express at the origin country. All import shipment s duties amount below myr 300 00 will be categorize as auto clearance shipment through sf malaysia. Senarai zon bebas pihak berkuasa zon.

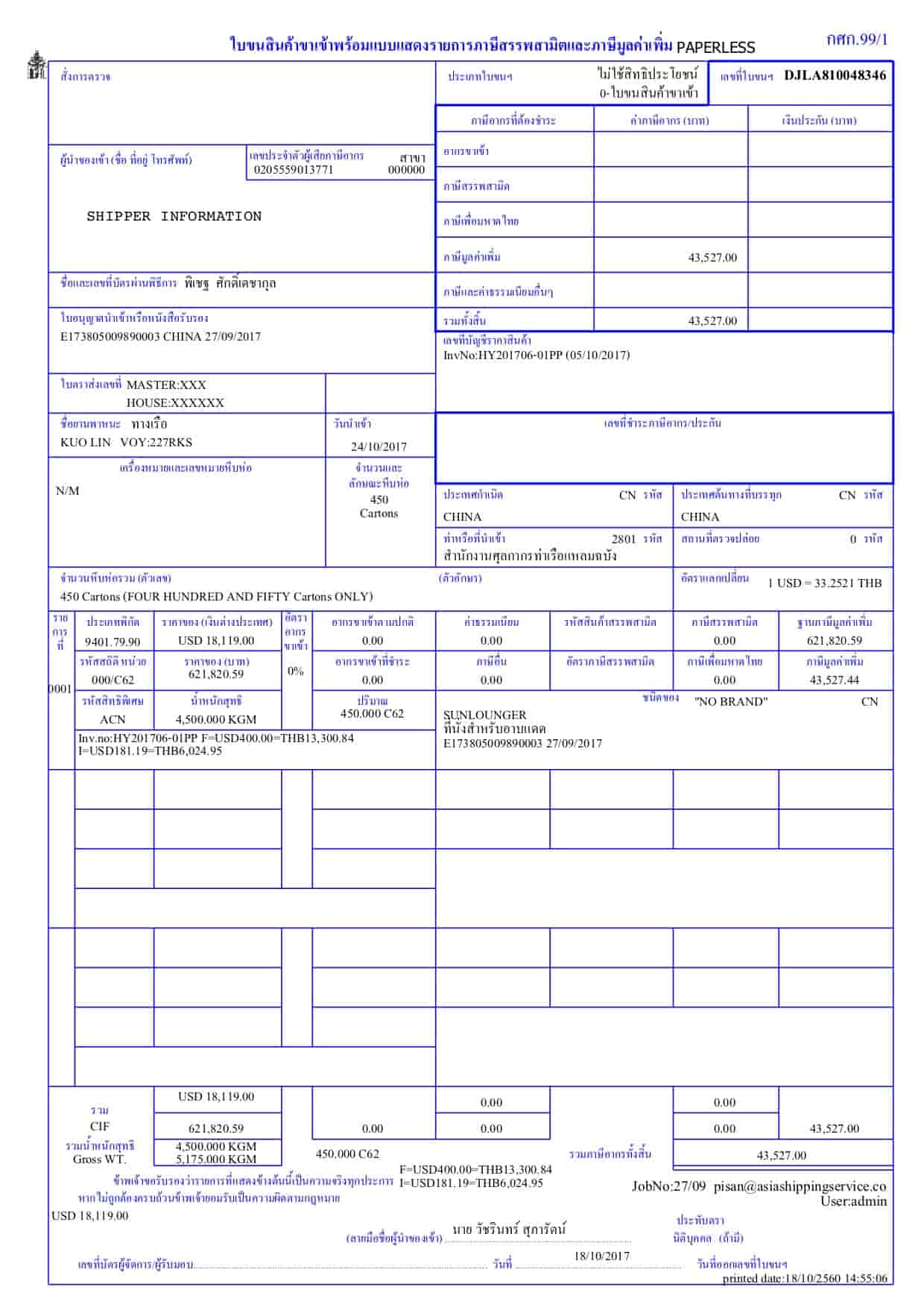

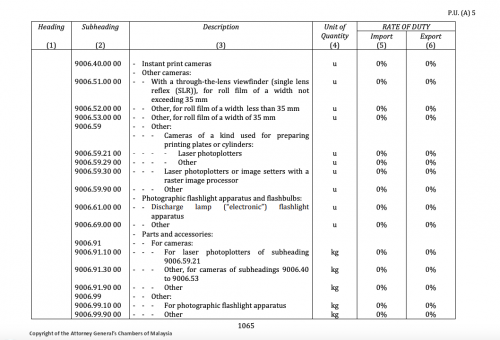

Malaysian customs imposes a standard goods and service tax gst on imported goods at 6 percent. Malaysian customs apply either a reduced tariff or else a tariff exemption on raw materials imported into malaysia for use in the manufacture of exported goods particularly when such raw material is difficult to source domestically. See what to expect when shipping internationally and how to reduce time at the border.

Malaysia customs apply a tariff on. Customs clearance when sending goods abroad customs can cause delays. Export tariffs and taxes.

Tatacara permohonan zon bebas. Basics to clear customs. Ensure that you are fully aware of licensing special provisions and restricted and prohibited goods in.

Tatacara permohonan zon bebas. Authorised economic operator aeo asean customs transit system acts free zone. Senarai zon bebas pihak berkuasa zon.

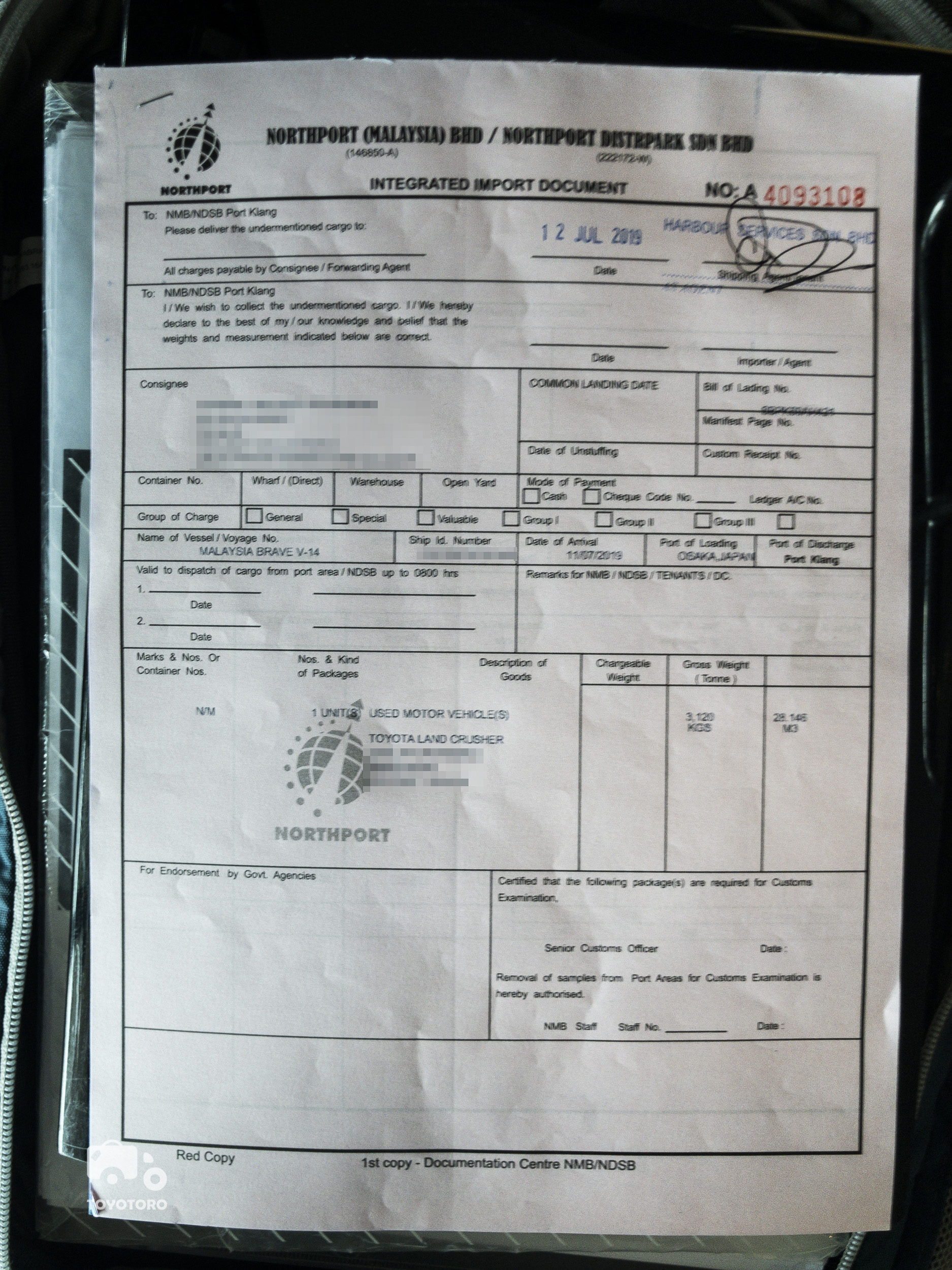

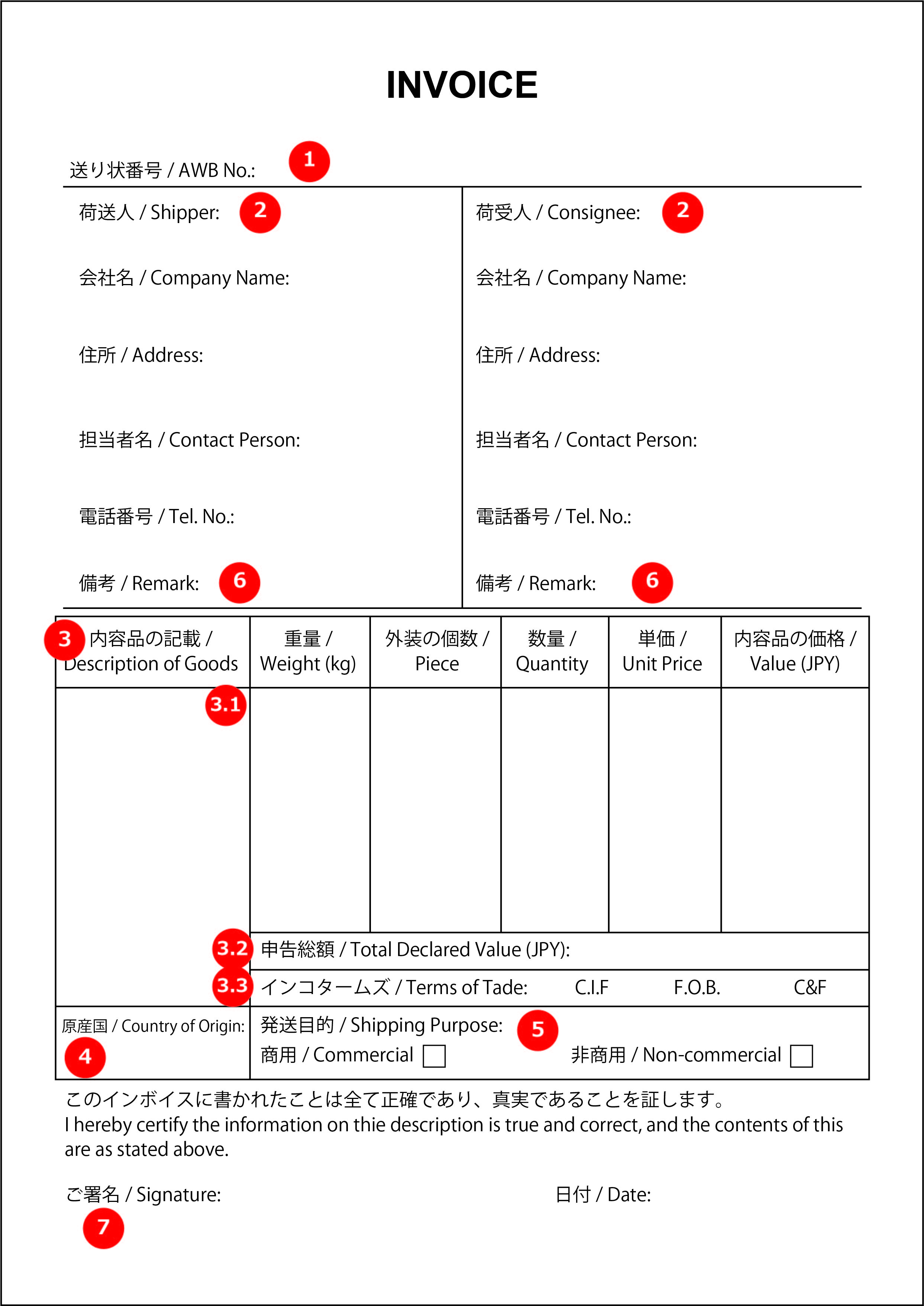

Customs duties exemption order 2017. It cannot be anticipated on the freight quote but cbp may at their discretion conduct an examination accruing costs for you refer isf filing above. In order to perform customs clearance a full set of complete invoice and the air.

Authorised economic operator aeo asean customs transit system acts free zone. Zon bebas adalah satu kawasan yang dianggap di luar malaysia yang diperuntukkan di bawah seksyen 2 1a akta kastam 1967 seksyen 2 akta eksais 1976 seksyen 2 akta cukai jualan 1972 dan seksyen 2a akta cukai. A handling fee of myr 53 00 per shipment will be charge to consignee s import shipment whenever there is an incurred duty tax.

Customs clearance fee tips. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. Dato sri abdul latif bin abdul kadir director general of customs royal malaysian customs royal malaysian customs department tribunal rayuan kastam trk malaysian.

Custom clearance surcharge below conditions are applicable to shipments inbound into malaysia. Variations in regulations mean that exporting can differ from country to country. Penggunaan borang ikrar di zon bebas.

Zon bebas adalah mana mana bahagian malaysia yang diisytiharkan di bawah peruntukan seksyen 3 1 akta zon bebas 1990 menjadi suatu zon perdagangan bebas atau zon perindustrian bebas.